blog | 4min Read

Published on February 12, 2022

Humour as a Leadership Skill

Every room needs laughter. Perhaps your comedian career started from home, or maybe in the school bus, or if you are like me, maybe you are lucky enough to be recognised as the “Class Clown”. Infamously known for their ability to inject humour and passing wisecracks to send people burst into laughter during classroom discussions, the ‘Class Clowns’ are constantly surveillanced by most of the teachers. Despite being more than often relegated to the back of the class, these Class Clowns, as various studies point out, have a tendency to display leadership characteristics including being confidently expressive about their ideas and opinions in front of their classmates.

The Michael Scott Way!

In the famous TV sitcom The Office, one can see how Michael Scott, played by Steve Carell, was beloved for his management skills, both good and bad. Michael was a lot of things a leader isn’t; he was brash, he was inappropriate (at times), and most of all, he treated the workspace as a family. Yet, despite having made poor choices in managing his employees, his branch was the highest earning branch across all Dunder Mifflin offices. So how did he manage to pull it off? Michael made sure that humour was central to his management; he made people laugh, built relationships and fostered a positive work environment. He made the workplace fun and wasn’t really afraid to embarrass himself every now and then. As the 34th US President Dwight D. Eisenhower once said “A sense of humour is part of the art of leadership, of getting along with people and getting things done.” Humour might just turn out to be your superhero strength, if managed efficiently and appropriately.

One of the greatest plus points of injecting humour and to burst out laughing is that it releases highly sought after chemicals in your brain – oxycontin, dopamine and endorphins. The holy trinity of these three neurochemicals being released into your body would mean that your mental status is more positive and upbeat than ever before. Other benefits also include stress relief, low anxiety and an improved mood. All together, this paints a more positive image of yourself, making you seem more positive and approachable to talk to.

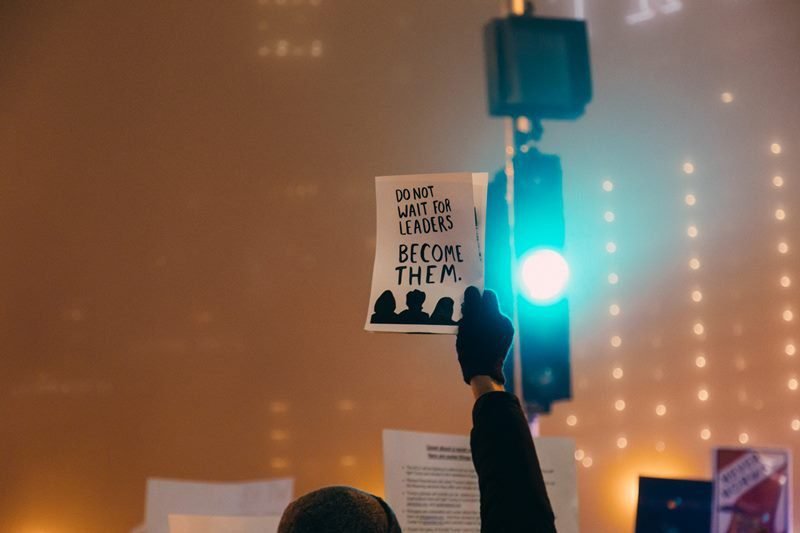

Why Is Humor Even More Important Today?

In today’s age, where the pandemic has made us all become socially and emotionally distant, the entire definition of a “leader” needs to be reimagined. Leaders now need to be seen as emotionally available and connected to their team along with being cognitively vigilant. In such a time, injecting a little bit of humour and laughter into the workspace can help in improving empathy and the ability to listen to others, both soft skills being fundamental to any leader’s characteristics. If leaders do manage to pull off being subtly and aptly funny in difficult situations, such traits can help in enhancing their leadership ability and improve their persona over the rest of the team. While leadership is pictured as being a serious matter, it is important to lead with a human touch. Humour thus serves as the bridge that connects these two worlds together.

Dozens of studies point towards the positive impact that humour has on your professional life. Leaders with a sense of humour are seen as 27% more motivating and admired than those who don’t have a sense of humour. 91% of executives, according to one study, believe that a sense of humour is essential for career advancement. Another research suggests that the two most desirable traits that are seen in leaders are a strong work ethic and a good sense of humour. Thus it is safe to say that humour is one of the most powerful tools for success, and so when humour is activated, your inside “spidey sense” heightens, making us more confident, creative and resilient.

So how do we harness humour to unleash our leadership potential?

Knowing Your Audience

This is one of the most fundamental aspects of learning when to be humorous and when not to be. The better you know and understand your audience, the better you can customize and tailor-make your jokes so that it might not come across as unintentionally aggressive. This is particularly important as, while humour does hold the key to making you a liked figure at your workplace, it also holds the power to drag you down. It is thus important to be mindful of your audience; whom you are telling the joke to, and whom or what you are joking about.

Laughing At Others?

This is one of the tricky aspects of being humorous. Aggressive humour in the form of belittling others can have a negative effect on your image. Constant use of aggressive humour has a tendency of socially distance leaders from the rest of the team. The idea is to bring people together using humour rather than pulling them apart. Again, knowing your audience in such situations might come in handy.

Laughing At Yourself

Mickey Mouse perfectly sums it up “To laugh at yourself is to love yourself.” Using self-defeating humour has a positive psychological effect on the minds of the rest of your team. This helps in allowing people to open up and talk more freely with leaders as they are deemed more approachable.

Ultimately, balancing the act of humour falls on you. Find the right balance and you can leverage humour to a great extent; making huge strides in your professional life. Despite being one of the most unlikely tools that one can relate leadership to, humour might just turn out to be the secret sauce that can make you stand out of a crowd, quite literally! So next time, feel confident to take your sense of humour for a spin and let the magic happen. Laugh more, and let your humour be used as a tool that lets you lead better!

Today, there is no shortage of resources that will take your financial knowledge to a new level. From magazines and books to videos and podcasts, you can choose the right option at your convenience to learn about money management for students and financial literacy in schools. You can go old-school, and pick up a book to start with or get on your smartphone to listen to amazing podcasts and videos. And they will shape your financial horizon in the following ways:

Today, there is no shortage of resources that will take your financial knowledge to a new level. From magazines and books to videos and podcasts, you can choose the right option at your convenience to learn about money management for students and financial literacy in schools. You can go old-school, and pick up a book to start with or get on your smartphone to listen to amazing podcasts and videos. And they will shape your financial horizon in the following ways: